I have decided to migrate from blogger to wordpress. Hence, all postings from December 2017 will only be found at

https://mrtfi2024.wordpress.com/

Saturday 2 December 2017

Tuesday 28 November 2017

Buy and sell actions in November

This month, I sold some counters to raise cash for more compelling ideas. Also, increase my stakes in a few of my US counters.

(figure in bracket represents the % the counter is occupying my portfolio based on cost)

Sold

1. Divested ISEC completely at $0.315 even though it has reported a good set of numbers in the latest quarter. Still find this an interesting outfit but decided to temporarily say goodbye to it as I wanted to buy other counters.

2. Sold Hock Lian Seng (2.0%) at $0.47 for a gain of 7.6%. This reduced my stake in the company and it now only occupies only 2% of my portfolio. Continue to believe in its ability to sustain its dividend based on the cash that it has and its strong order book. However, I relatively like my new positions.

Accumulate

1. Re-entered Capital Mall Trust (2.3%) at $2.02 after attending a sharing by Deputy CEO of Capital Mall Asia, Wilson Tan. Basically, he opined that retail mall is here to stay and Capital Mall will continue to be a powerhouse a decade later. With the purchase of CMT, I now own a slew of retail REITs but each for a different reason.

SG Reit - my longest holding for its focus on mall in prime area and its overseas exposure.

FCT - for its focus on sub-urban malls with most of them near MRT stations.

CMT - for not resting on its laurels and continues to take actions to be at the fore-front of retail mall.

2. Added more UMS (4.1%) at $1.05 after it announced a good set of Q3 results. Optimistic about its upcoming performance for the next few quarters and confident that it will at least maintain its dividend.

3. Added Intuitive Surgical (1.1%) @388.85 as I forgot to update my spreadsheet for its stock split! Luckily, bought only 4 shares to round up my total shares to 10. Let's hope it can continue with its splendid growth, then the mistake can become a blessing in disguise.

4. Added Vail Resorts (0.7%) @235.77 as it continues to report good growth from its acquisition. While management guided that 2018 growth might be slower due to the strong growth this year, long term prospect should remain good.

5. Re-entered Priceline (1.0%) @1655.75. I had sold earlier in September at 1840.6, making a loss of 5.1%. Since then the group announces a solid Q3 results which beats its own guidance. However, the market bashed it down due to another muted Q4 guidance. Seeing that Priceline always beats its own estimate, I decided to re-enter Priceline at a better price.

(figure in bracket represents the % the counter is occupying my portfolio based on cost)

Sold

1. Divested ISEC completely at $0.315 even though it has reported a good set of numbers in the latest quarter. Still find this an interesting outfit but decided to temporarily say goodbye to it as I wanted to buy other counters.

2. Sold Hock Lian Seng (2.0%) at $0.47 for a gain of 7.6%. This reduced my stake in the company and it now only occupies only 2% of my portfolio. Continue to believe in its ability to sustain its dividend based on the cash that it has and its strong order book. However, I relatively like my new positions.

Accumulate

1. Re-entered Capital Mall Trust (2.3%) at $2.02 after attending a sharing by Deputy CEO of Capital Mall Asia, Wilson Tan. Basically, he opined that retail mall is here to stay and Capital Mall will continue to be a powerhouse a decade later. With the purchase of CMT, I now own a slew of retail REITs but each for a different reason.

SG Reit - my longest holding for its focus on mall in prime area and its overseas exposure.

FCT - for its focus on sub-urban malls with most of them near MRT stations.

CMT - for not resting on its laurels and continues to take actions to be at the fore-front of retail mall.

2. Added more UMS (4.1%) at $1.05 after it announced a good set of Q3 results. Optimistic about its upcoming performance for the next few quarters and confident that it will at least maintain its dividend.

3. Added Intuitive Surgical (1.1%) @388.85 as I forgot to update my spreadsheet for its stock split! Luckily, bought only 4 shares to round up my total shares to 10. Let's hope it can continue with its splendid growth, then the mistake can become a blessing in disguise.

4. Added Vail Resorts (0.7%) @235.77 as it continues to report good growth from its acquisition. While management guided that 2018 growth might be slower due to the strong growth this year, long term prospect should remain good.

5. Re-entered Priceline (1.0%) @1655.75. I had sold earlier in September at 1840.6, making a loss of 5.1%. Since then the group announces a solid Q3 results which beats its own guidance. However, the market bashed it down due to another muted Q4 guidance. Seeing that Priceline always beats its own estimate, I decided to re-enter Priceline at a better price.

Tuesday 14 November 2017

Core holdings quarterly report (October to December) Part 2 - Non-Reit

This is part 2 of core holdings quarterly report which focus non-Reit counters.

iFAST and 800 Super replaces Micro-Mechanics and SingTel in the core holdings since the last quarterly report. Micro-Mechanics was divested before its last quarterly results as my return provided 5 to 6 years of dividend which was my initial investment reason. Since my divestment, its price has continued to hit new high to remind me of my pain. SingTel just dropped out of the core holdings as I purchased more of the other counters.

The tables below summarizes their performances for the latest quarter.

A+

A

Food Empire

Food Empire reported another good quarter with a minor increase in its revenue and a higher growth in its net profit. From the beginning of its turnaround last year, it has continued to generate good cash flow. Coupled with its regular scheduled repayments of its debt, the company is finally in net cash position after being in net debt from 2013.

Going forward, the growth might not be as strong with management highlighting stiff competition for IndoChina market and maturity of its ingredient business. With the positive experience in the ingredient business and increase in cash, I am confident that the management will announce further expansion in the upstream project in due course.

Having average up a few times over the past year, Food Empire is currently my top holding, occupying 8.5% of my portfolio (by cost). While I believe that it will continue to do well and pay out more dividend, I will not add on more shares as its growth might slow and currency risk while reduced, is still a concern.

iFAST

iFast continues with a strong showing this quarter as compared to previous year. However, the increase is much lesser from previous quarter. I expect the momentum to continue and its Q4 will be about the same as this quarter, with the potential of upside surprise. The company has also increased its dividend by 10% from $0.0068 to $0.0075.

High valuation of PE 29x if Q4 results is within my expectation and PEG of about 1. So pretty much fairly priced but I continue to like how the company goes about executing its strategies. While China loss widens, it continues to establish itself. the recent step in an institutional business partner in China (Beijing Financial Alliance Technology Co Ltd) is evident of its effort.

I am happy with the gradual growth for the next one to two years with the a possible explosion in growth (and price) once it establishes itself in the China market.

B

Straco

As I was expecting quarter three to continue its growth momentum from the previous two quarters, I was disappointed to see the dip in performance when I first took a glance at the results. Feeling more neutral when I realized that the weaken performance is largely attributed to UWX due to a restriction of visitor to the island. The other attractions reported an increase in revenue.

Straco continues to generate a large amount of cash and now has a net cash position of 137 mil. With a quarter to go, I would expect its net cash to be in the range of 140 to 150 mil by the end of this financial year. That is a whooping $0.17 per share.

Before Straco bought Singapore Flyer (SF) in 2014, it generated about 12 to 15 mil per year. When it acquired SF, its net cash was at 110 mil. After SF, it has been generating about 40 mil per year and with the record cash that it is holding, I am pretty confident that it will increase its dividend for this year.

Hence, I will continue to hold on to my current stake. I am unlikely to increase my stake further until there is more clarity on how the company is going to deal with the cash that they have.

800 Super

800 Super produces a stable quarter with minor increase in revenue and minor decrease in net profit compared to previous year. However, its performance is better than the previous quarter and net profit margin is back to 11%.

It has obtained TOP for its WTE plant and will be carrying out testing of its biomass boiler. The plant is expected to commence operation from 2018 first quarter. The development of sludge treatment plant is in progress and is on track for completion in 2018 second quarter.

Looking forward to the completion of the above two projects in the coming quarters.

VICOM

Vicom produces another stable quarter with minor decline compared to the previous years. Next quarter's report will be interesting as we can see the effect of the minor price adjustment for vehicle inspection.

I continue to stay confident of its ability to generate cash and am quite sure it will at least maintain its dividend by the end of the year.

C

Raffles Medical Group

Results continues to be flat with Hospital Services Division's revenue increased by 3.1% but Healthcare Services Division's revenue decreased by 4.2%. Looking forward to the opening of

Raffles Hospital Extension by end of this year which should improve both top and bottom lines as it has been operating at full capacity in recent times.

It continues to generate strong cash flow and cash balance has maintained at around 110 mil, even after distribution of 9 mil of dividend and payment of 31 mil for investment properties under development.

With Raffles Chongqing opening in 2018 second half and Raffles Shanghai in 2019 second half, it is exciting time for the company.

A "C" grade for current performance but a "B" for its potential in the new few years. I will continue to hold on to my current stake and may add more at the appropriate juncture.

iFAST and 800 Super replaces Micro-Mechanics and SingTel in the core holdings since the last quarterly report. Micro-Mechanics was divested before its last quarterly results as my return provided 5 to 6 years of dividend which was my initial investment reason. Since my divestment, its price has continued to hit new high to remind me of my pain. SingTel just dropped out of the core holdings as I purchased more of the other counters.

The tables below summarizes their performances for the latest quarter.

A+

Valuetronics

Another fantastic quarter by Valuetronics. Revenue and net profit increases for the seven consecutive quarters, contributed by both CE and ICE segments. The strong performance for the past few quarters have been attributed to smart lightings of CE segments. The ICE continues to grow but at a slower rate.

It also declared its first interim dividend of HK 7 cents. The momentum should continue to carry on for a few more quarters and I hope to hear more growth from its ICE segments, since it has increased its capital expenditure for the last 2 quarters on new machineries.

At forward PE of about 12x (and only 9x excluding cash), and probable yield of about 4.6% (based on $1 price), it is not a compelling buy. Having said that if the price corrects to around $0.90 or more good news is announced in the coming quarter, I might add more.

Food Empire

Food Empire reported another good quarter with a minor increase in its revenue and a higher growth in its net profit. From the beginning of its turnaround last year, it has continued to generate good cash flow. Coupled with its regular scheduled repayments of its debt, the company is finally in net cash position after being in net debt from 2013.

Going forward, the growth might not be as strong with management highlighting stiff competition for IndoChina market and maturity of its ingredient business. With the positive experience in the ingredient business and increase in cash, I am confident that the management will announce further expansion in the upstream project in due course.

Having average up a few times over the past year, Food Empire is currently my top holding, occupying 8.5% of my portfolio (by cost). While I believe that it will continue to do well and pay out more dividend, I will not add on more shares as its growth might slow and currency risk while reduced, is still a concern.

iFAST

iFast continues with a strong showing this quarter as compared to previous year. However, the increase is much lesser from previous quarter. I expect the momentum to continue and its Q4 will be about the same as this quarter, with the potential of upside surprise. The company has also increased its dividend by 10% from $0.0068 to $0.0075.

High valuation of PE 29x if Q4 results is within my expectation and PEG of about 1. So pretty much fairly priced but I continue to like how the company goes about executing its strategies. While China loss widens, it continues to establish itself. the recent step in an institutional business partner in China (Beijing Financial Alliance Technology Co Ltd) is evident of its effort.

I am happy with the gradual growth for the next one to two years with the a possible explosion in growth (and price) once it establishes itself in the China market.

B

Straco

As I was expecting quarter three to continue its growth momentum from the previous two quarters, I was disappointed to see the dip in performance when I first took a glance at the results. Feeling more neutral when I realized that the weaken performance is largely attributed to UWX due to a restriction of visitor to the island. The other attractions reported an increase in revenue.

Straco continues to generate a large amount of cash and now has a net cash position of 137 mil. With a quarter to go, I would expect its net cash to be in the range of 140 to 150 mil by the end of this financial year. That is a whooping $0.17 per share.

Before Straco bought Singapore Flyer (SF) in 2014, it generated about 12 to 15 mil per year. When it acquired SF, its net cash was at 110 mil. After SF, it has been generating about 40 mil per year and with the record cash that it is holding, I am pretty confident that it will increase its dividend for this year.

Hence, I will continue to hold on to my current stake. I am unlikely to increase my stake further until there is more clarity on how the company is going to deal with the cash that they have.

800 Super

800 Super produces a stable quarter with minor increase in revenue and minor decrease in net profit compared to previous year. However, its performance is better than the previous quarter and net profit margin is back to 11%.

It has obtained TOP for its WTE plant and will be carrying out testing of its biomass boiler. The plant is expected to commence operation from 2018 first quarter. The development of sludge treatment plant is in progress and is on track for completion in 2018 second quarter.

Looking forward to the completion of the above two projects in the coming quarters.

VICOM

Vicom produces another stable quarter with minor decline compared to the previous years. Next quarter's report will be interesting as we can see the effect of the minor price adjustment for vehicle inspection.

I continue to stay confident of its ability to generate cash and am quite sure it will at least maintain its dividend by the end of the year.

C

Raffles Medical Group

Results continues to be flat with Hospital Services Division's revenue increased by 3.1% but Healthcare Services Division's revenue decreased by 4.2%. Looking forward to the opening of

Raffles Hospital Extension by end of this year which should improve both top and bottom lines as it has been operating at full capacity in recent times.

It continues to generate strong cash flow and cash balance has maintained at around 110 mil, even after distribution of 9 mil of dividend and payment of 31 mil for investment properties under development.

With Raffles Chongqing opening in 2018 second half and Raffles Shanghai in 2019 second half, it is exciting time for the company.

A "C" grade for current performance but a "B" for its potential in the new few years. I will continue to hold on to my current stake and may add more at the appropriate juncture.

Thursday 9 November 2017

Core holdings quarterly reporting (October to December) Part 1 - Reit

Decide to break up my core holdings quarterly reporting to two parts as my 3 REITS have completed reporting and the rest of my holdings are still reporting their results until the end of the month.

Again, my definition of core holdings are counters which I am more familiar with. These are counters which I am more confident of and have a more substantial holding (about 5% of portfolio); hence I am more likely to hold them for a longer period of time.

The tables below summarizes the 3 REITs performances for the latest quarter.

A+

Frasers Centrepoint Trust

As seen from the above table, FCT reported a strong quarter with increase in revenue, net property income, DPU and NAV. This despite the fact that Northpoint City is still about 18% vacant due to AEI. The strong showing comes from increase in occupancy in Changi City Point and Bedok Point, and 8.3% rental reversion for the past quarter.

I expect even better performance for the next two quarters with completion of Northpoint City. Also, with the opening of Downtown line, that will boost the traffic to Changi City Point.

The DPU might not jump in quantum as I think the proportion of management fees to be paid in Units will reduce from the current quarter of 70%. However, I believe that the management will want to continue to increase its DPU for the 12th straight year. Hence, I expect its DPU for next year will grow between 3% to 6%.

Also, with a low gearing of only 29%, acquisition of Punggol Waterway Point within the next few years is definitely a possibility.

The price of the counter has gone up quite a bit before the results is announced. It dipped to $2.17 recently which is not cheap with respect to its NAV of $2.02. However, with its proven track record and my thinking of its next year's DPU, I increased my stake by another 25%. With this increase, my average price is $2.06.

A

ParkwayLife REIT

Parkwaylife continues its stable and strong performance. Even excluding the divestment gain, its DPU has gone up by 2.9% compared to 2016Q3. For this financial year, its DPU has slowly increase too (Q1 3.06, Q2 3.10, Q3 3.15). No complain about it except that its price has really run up too much for me to accumulate further at this point. Might start considering again if yield increases to at least 4.8%.

C

Starhill Global REIT

All metric continues to drop as compared to a year ago but it seems to have stablized over the previous quarters. The key concern still lies with its office occupancy but the bright spot is management has shared that they are finalising the deal for 1/3 of its vacant space.

Going forward, things should look slightly brighter with the above, completion of Australia AEI and stable income from China properties. The price seems to have factored in the outlook as it hardly move after the announcement of the weaker results. I am going to continue to hold on to my current stake (average price of $0.70) which occupies 4.8% of portfolio.

Again, my definition of core holdings are counters which I am more familiar with. These are counters which I am more confident of and have a more substantial holding (about 5% of portfolio); hence I am more likely to hold them for a longer period of time.

The tables below summarizes the 3 REITs performances for the latest quarter.

Frasers Centrepoint Trust

As seen from the above table, FCT reported a strong quarter with increase in revenue, net property income, DPU and NAV. This despite the fact that Northpoint City is still about 18% vacant due to AEI. The strong showing comes from increase in occupancy in Changi City Point and Bedok Point, and 8.3% rental reversion for the past quarter.

I expect even better performance for the next two quarters with completion of Northpoint City. Also, with the opening of Downtown line, that will boost the traffic to Changi City Point.

The DPU might not jump in quantum as I think the proportion of management fees to be paid in Units will reduce from the current quarter of 70%. However, I believe that the management will want to continue to increase its DPU for the 12th straight year. Hence, I expect its DPU for next year will grow between 3% to 6%.

Also, with a low gearing of only 29%, acquisition of Punggol Waterway Point within the next few years is definitely a possibility.

The price of the counter has gone up quite a bit before the results is announced. It dipped to $2.17 recently which is not cheap with respect to its NAV of $2.02. However, with its proven track record and my thinking of its next year's DPU, I increased my stake by another 25%. With this increase, my average price is $2.06.

A

ParkwayLife REIT

Parkwaylife continues its stable and strong performance. Even excluding the divestment gain, its DPU has gone up by 2.9% compared to 2016Q3. For this financial year, its DPU has slowly increase too (Q1 3.06, Q2 3.10, Q3 3.15). No complain about it except that its price has really run up too much for me to accumulate further at this point. Might start considering again if yield increases to at least 4.8%.

C

Starhill Global REIT

All metric continues to drop as compared to a year ago but it seems to have stablized over the previous quarters. The key concern still lies with its office occupancy but the bright spot is management has shared that they are finalising the deal for 1/3 of its vacant space.

Going forward, things should look slightly brighter with the above, completion of Australia AEI and stable income from China properties. The price seems to have factored in the outlook as it hardly move after the announcement of the weaker results. I am going to continue to hold on to my current stake (average price of $0.70) which occupies 4.8% of portfolio.

Monday 30 October 2017

A look at my recent buys (Part 3) - 800 Super

I first came across 800 Super in 2015 when its price was only

40+ cents. A cusory glance at its balance sheet puts me off as it is in a net

debt position and its debt had been increasing. The company’s share price burst

into action in the second half of 2016 and reaches a high of $1.38 on 12 May

2017.

I finally took a small bite of it at $0.93 in December 2016 and sold

it off at $1.26 in May 2017 for a 36% gain. The recent dip in its price to

$1.1+ allows me to take a second bite at it. Together with the few recent buys

of iFast, Hock Lian Seng and UMS, I decided to take a closer look at the

company’s past record.

What do they do?

Listed on Catalist on 15 July 2011, 800 Super is an established environmental services provider for both the public and private sectors in Singapore. The Company's environmental services include waste management, cleaning and conservancy and horticultural services. The company is one of the four licenses public water collectors appointed by NEA. It has been the Public waste collector for Ang Mo Kio-Toa Payoh sector since July 2006, and was re-awarded the contract in 2014 for 7 years and 9 months.

In its IPO

document, the company stated the following as their business strategies and

future plans.

• Expand our

material recovery facilities capacity and the capacity of our vehicle depots

• Enhance the

efficiency of our services and capacity

• Venture into

waste treatment and renewable energy businesses

• Focus on

public sector projects

• Continue to

focus on operational excellence

• Explore

strategic investments or alliances and acquisitions

• Expand into

overseas markets

Based on the

past few years record, tt seems that they have been executing their plans, with

the completion of the material recovering plants and vehicle depot at Tuas

South. Also, they were awarded integrated public cleaning for North-West (6 years)

and South-West (7 years) sectors in 2014.

Recent Development

The group had a hiccup in its growth of both top and bottom line

in the latest year with poorer performance in the last 2 quarters. This

coincides with the delay of its completion of its Waste-to-Energy (WTE) plant

which was slated to be in operation in 2017Q2. I suspect they are ironing out

some teething problems and hopefully it can come into operation by end 2017.

In October 2016, the company was awarded a15-and-a-half-year,

S$133.65 million contract that the Public Utilities Board (PUB) for a sludge

treatment facility. This is slated to be completed in 2018 second quarter.

In the latest financial year, the

company continues to increase its dividend from 2.5 cents to 4.0 cents.

Management

The Lee brothers Lee Kok Yong (Chairman), Lee Cheng Chye (CEO)

and Lee Hock Seong collectively have a 75% stake fo the company.

It is my opinion that they are networker and are

people-oriented leaders with interest aligned to the shareholders. My opinion comes from the position they held

– Lee Kok Yong is a direction of Ang Mo Kio Joint Temple Association and Lee

Cheng Chye is currently the treasurer for Bishan East

Citizens Consultative Committee and was conferred the Public Service Medal

(PBM) by the President of Singapore at the 2015 National Day Awards.

The company has also

increased its dividend over the years, from 1 cent in 2012 to 4 cents in the latest financial year.

Crunching the numbers

The company has grown its EPS by about 24% over the past 5 years. I opined that the company can at least grow by 15% in the next few years which would give its PEG of about 0.85.

Dividend has been increasing and based on the payout ratio and

likely increase in cash balance, I think it can at least sustain its 4 cents

and that provides an yield of about 3.3% based on current price of $1.215.

The company seems to believe in using debt to grow and it is not

something that I am comfortable with. However, its ability to generate cash is

improving over the past few years and net debt has gone down until the recent

increase in debt to finance the buiding of the sludge treatment plant.

Conclusion

After taking a closer look at the company, I must say that I am

impressed by how the company has kept to what it has set out to do in its IPO.

It has grown over the past 5 years and increases its dividend. While debt is

something I am not comfortable with, it seems that the company has been able to

deal with it and moving forward, the chance of paring it down seems high.

Weighing the risk and reward, I decided to add on to my holding

today, resulting in an average price of

$1.16. It now occupies 5.4% of my portfolio.

Thursday 26 October 2017

A look at my recent buys (Part 2) - Hock Lian Seng vs UMS

Hock Leng Seng (HLS) vs UMS? Why compare them? How are they related?

Nothing except that both are listed on Singapore Exchange and I bought them recently in September as dividend counters.

What do they do?

Hock Lian Seng is a leading civil engineering group that is established for 45 years. It is listed on SGX mainboard in December 2009. At any one period, the group does not have many projects but they have big projects with revenue that is recognized over a few years. Some recent completed projects include Marina Bay Station, Marina Coastal Expressway. On-going projects include CAG airport runway and Maxell Station. Upon listed, they forayed into property development and had developed industry building such as ARK@Gambas and ARK@KB and collaborated to developed the Skywoods condominium. The remaining project that the group is doing now is Shine@Tuas South. The other segment is investment properties which contributed negligibly in the latest financial year.

As seen from the segment value, the group seems to have gone a full circle with tapering civil engineering projects to an increase in it after a few years in experimenting properties development and investment. Going forward, it seems that they will be focusing on civil engineering business.

UMS is a is a one-stop strategic integration partner providing equipment manufacturing and engineering services to Original Equipment Manufacturers of semiconductors and related products. It is formed with the merger of Norelco Centreline (listed on SESDAQ in 2001 and upgraded to mainboard in 2003) with UMS Semiconductor in 2004. The key change in their product occurred in 2010/2011 when they acquired Integrated Manufacturing Technologies Pte Ltd and Integrated Manufacturing Technologies Inc. Since then, their revenue is mainly from Applied Materials.

Recent development, results and price movement

Hock Lian Seng proposed a special dividend of 10 cents in the latest financial year. Wow, a big windfall for investors who have invested in the company before that. Unfortunately, I am not one of them. 20171H performance has been muted as there is no contribution from property development. Revenue from Civil Engineering segment was flat from previous year. The bright spot since the beginning of the year is the record order book which stands at a high of 890 million. Also, it has about 27 cents of cash per share which means I am just paying about 18 cents for its solid order book. Share had drifted to $0.4+ in August/September when I made my purchase. It was moving up over the past week and is now at $0.51.

UMS renewed its integrated system contract with Applied Material for 3 years (and has the option of extending it for another 3 years). It is also attempting to diversify its customer base by subscribing to 51% of the enlarged share capital of Kalf. Recently, it has also gone XB for its 1-for-4 bonus. Its price has dropped from its high of $1.2+ (pre-bonus) in May/June to $0.9 (pre-bonus) when I made my purchase. It has gone ballistic after XB recently and is now at $0.99 (post-bonus).

Dividend and Sustainability?

Year HLS UMS

2016 12.5 c 4.8 c (adj)

2015 2.5 c 4.8 c (adj)

2014 4.0 c 4.2 c (adj)

2013 1.8 c 3.8 c (adj)

2012 1.8 c 3.8 c (adj)

As seen from the above table, both companies have been quite consistent in giving out dividends with HLS giving out special dividend periodically and UMS has increased its dividend.

Dividend payout for HLS around mid 30%, while UMS ranges from 70+% to 100+% if based on net profit. Based on free cash flow, UMS is around low 80%. Also, as mentioned earlier, HLS has about 27 cents in cash; while UMS cash holding is around 14 cents.

Based on the above, I am quite confident that both companies will sustain their pay out in the coming year (HLS – 2.5c, UMS – 6c) and this will translate to a yield of about 4.9% for HLS and 6.1% for UMS.

Conclusion

I first purchased both when their price has slid downwards in August/September. I was quite impressed by Hock Leng Seng as it has a strong net profit margin and return of equity. The property development has probably masked the NPM and ROE figures and I have not spent time drilling down on its AR. However, if I based it on 2009, 2010 figures when property development has not started NPM is around 10% and ROE is high 20%. Impressive numbers.

Based on these numbers, order book and cash per share, I have added slightly more this month, bringing my average price to $0.45. I would like to see how things unfold in the coming quarters before deciding if I would accumulate more.

With the contract renewal, there is more certainty of UMS for at least the next few years. I have not added to UMS since my purchase at an average price of $0.76 (adj) in August, as the price has ran up and I was waiting to see if it would correct to below $0.80 after XB. The run up after XB was totally unexpected. I would be waiting for its Q3 results and the price then before making further decision.

Nothing except that both are listed on Singapore Exchange and I bought them recently in September as dividend counters.

What do they do?

Hock Lian Seng is a leading civil engineering group that is established for 45 years. It is listed on SGX mainboard in December 2009. At any one period, the group does not have many projects but they have big projects with revenue that is recognized over a few years. Some recent completed projects include Marina Bay Station, Marina Coastal Expressway. On-going projects include CAG airport runway and Maxell Station. Upon listed, they forayed into property development and had developed industry building such as ARK@Gambas and ARK@KB and collaborated to developed the Skywoods condominium. The remaining project that the group is doing now is Shine@Tuas South. The other segment is investment properties which contributed negligibly in the latest financial year.

As seen from the segment value, the group seems to have gone a full circle with tapering civil engineering projects to an increase in it after a few years in experimenting properties development and investment. Going forward, it seems that they will be focusing on civil engineering business.

UMS is a is a one-stop strategic integration partner providing equipment manufacturing and engineering services to Original Equipment Manufacturers of semiconductors and related products. It is formed with the merger of Norelco Centreline (listed on SESDAQ in 2001 and upgraded to mainboard in 2003) with UMS Semiconductor in 2004. The key change in their product occurred in 2010/2011 when they acquired Integrated Manufacturing Technologies Pte Ltd and Integrated Manufacturing Technologies Inc. Since then, their revenue is mainly from Applied Materials.

Recent development, results and price movement

Hock Lian Seng proposed a special dividend of 10 cents in the latest financial year. Wow, a big windfall for investors who have invested in the company before that. Unfortunately, I am not one of them. 20171H performance has been muted as there is no contribution from property development. Revenue from Civil Engineering segment was flat from previous year. The bright spot since the beginning of the year is the record order book which stands at a high of 890 million. Also, it has about 27 cents of cash per share which means I am just paying about 18 cents for its solid order book. Share had drifted to $0.4+ in August/September when I made my purchase. It was moving up over the past week and is now at $0.51.

UMS renewed its integrated system contract with Applied Material for 3 years (and has the option of extending it for another 3 years). It is also attempting to diversify its customer base by subscribing to 51% of the enlarged share capital of Kalf. Recently, it has also gone XB for its 1-for-4 bonus. Its price has dropped from its high of $1.2+ (pre-bonus) in May/June to $0.9 (pre-bonus) when I made my purchase. It has gone ballistic after XB recently and is now at $0.99 (post-bonus).

Dividend and Sustainability?

Year HLS UMS

2016 12.5 c 4.8 c (adj)

2015 2.5 c 4.8 c (adj)

2014 4.0 c 4.2 c (adj)

2013 1.8 c 3.8 c (adj)

2012 1.8 c 3.8 c (adj)

As seen from the above table, both companies have been quite consistent in giving out dividends with HLS giving out special dividend periodically and UMS has increased its dividend.

Dividend payout for HLS around mid 30%, while UMS ranges from 70+% to 100+% if based on net profit. Based on free cash flow, UMS is around low 80%. Also, as mentioned earlier, HLS has about 27 cents in cash; while UMS cash holding is around 14 cents.

Based on the above, I am quite confident that both companies will sustain their pay out in the coming year (HLS – 2.5c, UMS – 6c) and this will translate to a yield of about 4.9% for HLS and 6.1% for UMS.

Conclusion

I first purchased both when their price has slid downwards in August/September. I was quite impressed by Hock Leng Seng as it has a strong net profit margin and return of equity. The property development has probably masked the NPM and ROE figures and I have not spent time drilling down on its AR. However, if I based it on 2009, 2010 figures when property development has not started NPM is around 10% and ROE is high 20%. Impressive numbers.

Based on these numbers, order book and cash per share, I have added slightly more this month, bringing my average price to $0.45. I would like to see how things unfold in the coming quarters before deciding if I would accumulate more.

With the contract renewal, there is more certainty of UMS for at least the next few years. I have not added to UMS since my purchase at an average price of $0.76 (adj) in August, as the price has ran up and I was waiting to see if it would correct to below $0.80 after XB. The run up after XB was totally unexpected. I would be waiting for its Q3 results and the price then before making further decision.

Wednesday 25 October 2017

Buy and sell actions in October

Unlike the past 3 months, I have taken relatively less actions in October.

1. Added more iFAST as I felt excited and confident of its future growth after reading through the past annual reports. See previous post on my thoughts about the company. It now occupies 5.4% of my portfolio with my average price at $0.935.

2. Added more Hock Lian Seng after learning more about the company through the past annual reports. With a strong order book and balance sheet, feel confident that it can maintain its 2.5 cents of dividend. That gives me a yield of 5.5% with my average price of $0.454.

3. Added more Frasers Centrepoint Trust after its stellar Q4 performance and price dipped to $2.17 from the recent high of $2.2+. Expect DPU and NAV to continue to grow next year now that AEI of Northpoint is almost completed. Assuming that DPU comes in at 12.2 c, it will provide a yield of 5.6% at $2.17. My average price is now $2.06 which is only slightly above its current NAV of $2.02.

4. Bought ULTA Beauty at USD196.85. Felt that it was way oversold from its recent high of USD300 in June, especially when it is growing at 20% to 25% for this financial year. Its current PE of 25-27 is much lower than its past 5 years average of 38.

5. Bought 800 Super at $1.21. After a closer look at its business, decided that there is still room for growth in the next few years especially with the Waste-to-Energy (WTE) coming into operation at the end of this year.

6. Sold CDLHT at $1.63, making a small gain of 2.7%. DPU after rights is lower and the outlook of the hospitality sector probably need another year or two for greater clarity. So decided to sell and use the proceed for other counters.

7. Sold OUEHT at $0.805, making a gain of 5.8%. Similar reason on hospitality sector. Decided not to wait for quarterly results in the coming week as I have made a small gain and am unsure how the DPU will be affected as there will be no more income support.

1. Added more iFAST as I felt excited and confident of its future growth after reading through the past annual reports. See previous post on my thoughts about the company. It now occupies 5.4% of my portfolio with my average price at $0.935.

2. Added more Hock Lian Seng after learning more about the company through the past annual reports. With a strong order book and balance sheet, feel confident that it can maintain its 2.5 cents of dividend. That gives me a yield of 5.5% with my average price of $0.454.

3. Added more Frasers Centrepoint Trust after its stellar Q4 performance and price dipped to $2.17 from the recent high of $2.2+. Expect DPU and NAV to continue to grow next year now that AEI of Northpoint is almost completed. Assuming that DPU comes in at 12.2 c, it will provide a yield of 5.6% at $2.17. My average price is now $2.06 which is only slightly above its current NAV of $2.02.

4. Bought ULTA Beauty at USD196.85. Felt that it was way oversold from its recent high of USD300 in June, especially when it is growing at 20% to 25% for this financial year. Its current PE of 25-27 is much lower than its past 5 years average of 38.

5. Bought 800 Super at $1.21. After a closer look at its business, decided that there is still room for growth in the next few years especially with the Waste-to-Energy (WTE) coming into operation at the end of this year.

6. Sold CDLHT at $1.63, making a small gain of 2.7%. DPU after rights is lower and the outlook of the hospitality sector probably need another year or two for greater clarity. So decided to sell and use the proceed for other counters.

7. Sold OUEHT at $0.805, making a gain of 5.8%. Similar reason on hospitality sector. Decided not to wait for quarterly results in the coming week as I have made a small gain and am unsure how the DPU will be affected as there will be no more income support.

Saturday 7 October 2017

A closer look at my recent buys (Part 1) - iFAST

In August and early September, I have initiated positions on iFAST, Hock Lian Seng, UMS and 800 Super (re-entered) after chancing upon their price drop of about 20% from recent high in June. I did a quick scan on their news and did not find any major fundamental change in their business and hence took a bite.

I decided to take a closer look at the them to decide if I should add more to my initial holdings. I will start with iFAST as I am most excited about it after scanning through their latest annual reports.

What do they do?

Listed on SGX on 11 December 2014, iFAST business revolves around internet-based investment products distribution platform with assets-under-administration (AUA) of about 6.1 billions. It has presence in Singapore, Malaysia, Hong Kong and China. Two main business divisions, business-to-business (B2B) and business-to-consumer (B2C) with B2B contributing 75% of revenue in 2016. About 83% of its net revenue is recurring.

Recent development, results and price movement

iFAST has a strong rebound in their 20171H results. Revenue was up by about 20% and net profit up by 75% but this came from a weak 20161H results. The poor results in 2016, a 55% drop in EPS has caused the share price to plunge from $1.35 to $0.85 for that year. The price continued to slide in 2017 till April to reach a low $0.60. The release of its strong results this year has resulted in a strong rebound of its share price, reaching a high of $1.1+ in June.

It has also launched its SGX stockbroking service in June 2017 after being admitted as a Trading Member of Singapore Exchange Securities Trading Limited (“SGX-ST”) and a Clearing Member of The Central Depository (Pte) Limited (“CDP”).

Management

Based on what I read on the annual reports and action taken by the company, I think iFAST Chairman, CEO and co-founder Lim Chung Chun is a forward looking and strong leader who drives the company to put their company values (Integrity, Innovation and Transparency) into action. The following is the final paragraph from 2016 report.

With the exception of 2016, iFAST has grown both its top and bottom lines, with its EPS growth outpacing its net revenue growth.

Base on the above data, I believe the company should be able to continue to grow its earning at a rate of 20% to 30% for the next few years.

Valuation

Together with the rest of the market, iFAST's price has rebounded quite a bit since the beginning of October and closed at $0.96 on 6 October. Forward PE based on the current price and projected EPS is about 26x. Assuming I am right about its ability to grow at 20% to 30% in the next few years, forward PEG ranges from 1.1 to 1.3. My personal take is that it is fairly priced with potential to surprise on the up side but risk still lingers.

When will I sell?

These four rules still apply.

Conclusion

My first encounter with the company was more than a decade ago when I opened my Fundsupermart account. Did not really use its services as I was on dollardex then. Recently, I wanted to explore its FSMone platform for stock trading and hence decided to register an account. Apparently my record is still in their data base and I need to re-activate my account which I will probably do by the end of the year.

As an investing idea, I came across it somewhere in late 2015 but the PE was crazy then. The sell down due to poor results in 2016 and the recent correction provides me an opportunity to buy a small stake in the company.

I can sense my excitement as I read the development of iFAST over the years and imagine what more can come from them in years to come. Hence, I decided to buy more yesterday at a price of $0.975 (yes, I am not good at market timing). Together with my initial purchases, my average price is $0.93.

I am prepared to add more to this counter at the appropriate junctures.

I decided to take a closer look at the them to decide if I should add more to my initial holdings. I will start with iFAST as I am most excited about it after scanning through their latest annual reports.

What do they do?

Listed on SGX on 11 December 2014, iFAST business revolves around internet-based investment products distribution platform with assets-under-administration (AUA) of about 6.1 billions. It has presence in Singapore, Malaysia, Hong Kong and China. Two main business divisions, business-to-business (B2B) and business-to-consumer (B2C) with B2B contributing 75% of revenue in 2016. About 83% of its net revenue is recurring.

Recent development, results and price movement

iFAST has a strong rebound in their 20171H results. Revenue was up by about 20% and net profit up by 75% but this came from a weak 20161H results. The poor results in 2016, a 55% drop in EPS has caused the share price to plunge from $1.35 to $0.85 for that year. The price continued to slide in 2017 till April to reach a low $0.60. The release of its strong results this year has resulted in a strong rebound of its share price, reaching a high of $1.1+ in June.

It has also launched its SGX stockbroking service in June 2017 after being admitted as a Trading Member of Singapore Exchange Securities Trading Limited (“SGX-ST”) and a Clearing Member of The Central Depository (Pte) Limited (“CDP”).

Management

Based on what I read on the annual reports and action taken by the company, I think iFAST Chairman, CEO and co-founder Lim Chung Chun is a forward looking and strong leader who drives the company to put their company values (Integrity, Innovation and Transparency) into action. The following is the final paragraph from 2016 report.

"We are aware that our approach may sometimes cause disruption in the financial sectors that are often dominated by traditional business approaches and mores on how investors should be treated – if it means these disruptive changes we are introducing are pro-client, we will continue to remain steadfast in achieving this outcome in the markets we operate in. When changes are pro-client, we are confident we will succeed in the longer term despite shorter-term challenges."

And I do not think it's just talk. Fundsupermart.com in 2000, FSM Mobile in 2011, Bondsupermart in 2015, and robo-advisor last year are evidences that show that the company is among the first movers.

Crunching the numbersWith the exception of 2016, iFAST has grown both its top and bottom lines, with its EPS growth outpacing its net revenue growth.

Base on the above data, I believe the company should be able to continue to grow its earning at a rate of 20% to 30% for the next few years.

Valuation

Together with the rest of the market, iFAST's price has rebounded quite a bit since the beginning of October and closed at $0.96 on 6 October. Forward PE based on the current price and projected EPS is about 26x. Assuming I am right about its ability to grow at 20% to 30% in the next few years, forward PEG ranges from 1.1 to 1.3. My personal take is that it is fairly priced with potential to surprise on the up side but risk still lingers.

When will I sell?

These four rules still apply.

a. The fundamentals of the company has deteriorate

b. The company is overvalue at the current price

c. To raise cash for a better buying idea

d. To raise cash for other reasons

Conclusion

My first encounter with the company was more than a decade ago when I opened my Fundsupermart account. Did not really use its services as I was on dollardex then. Recently, I wanted to explore its FSMone platform for stock trading and hence decided to register an account. Apparently my record is still in their data base and I need to re-activate my account which I will probably do by the end of the year.

As an investing idea, I came across it somewhere in late 2015 but the PE was crazy then. The sell down due to poor results in 2016 and the recent correction provides me an opportunity to buy a small stake in the company.

I can sense my excitement as I read the development of iFAST over the years and imagine what more can come from them in years to come. Hence, I decided to buy more yesterday at a price of $0.975 (yes, I am not good at market timing). Together with my initial purchases, my average price is $0.93.

I am prepared to add more to this counter at the appropriate junctures.

Monday 2 October 2017

Why staying in the market works for me

In the recent 9-month report, I mentioned that I eked out a small return for the latest quarter due to a surge in price of Valuetronics and UMS in the last few days of September.

I am once reminded again that being an average retail investor, it works best for me when I just stay in the market, instead of frequent trading in an attempt to catch the low/high prices.

Taking a look at the year-to-date prices of a few of my holdings, one can see that the spike in prices only occur for a short period of time. Most of the time, the prices just fluctuate within a smaller range. If I have missed that few short periods, I would have miss the return.

|

| Valuetronics |

|

| Food Empire |

|

| Straco |

Of course, if I am a full-time expert trader and I monitor the price movement closely, I could still benefit from it. However, I am not and I couldn't possible be looking at the price movement so frequently while working. Even if I am not working, looking at the price at such frequency is not really what I would like to do.

Hence, the best method for me is to just find the correct business to invest in and once vested, stay in the market for as long as possible.

What if there is a market crash? Well, I just have to ride it out. Having a war chest also allows me to take the opportunity to buy more shares of the business that I like.

Friday 29 September 2017

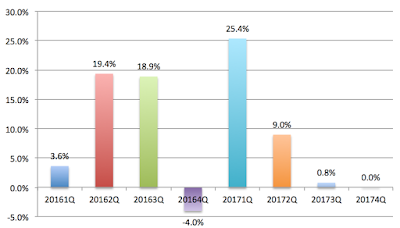

2017 9M performance

Performance

Another quarter has passed and it's time to take stock of portfolio's performance.

Another quarter has passed and it's time to take stock of portfolio's performance.

It is a muted performance for the quarter, resulting in a slight increase in NAV compared to 20171H performance. In fact, if not for the strong performance of Valuetronics and UMS over the past few days, this quarter will post a return lower than 20171H.

NAV of portfolio grew from $3.78 (30 Dec 2016) to $5.22 (30 Sep 2017), providing a return of 37.8% for 9 months. Definitely happy as this is well above my stretched target of 12% and also beats benchmark STI ETF which returned about 14% (inclusive of dividend) over the same period.

The muted quarter's performance can be attributed to the following:

- weaker market sentiment for the past quarter,

- continued sell-down of Raffles Medical Group,

- correction of Food Empire,

- divestment of Micro-Mechanics which shot up 20% after I sold, *ouch*

- increase in trading activities as I look for new ideas for the next few years.

Gainers and losers

The following tables show the top gainers and losers for this year thus far. The list should remain pretty much the same by end of the year.

I am glad that 7 out of my 10 core holdings have returned more than 10% thus far this year. Even with the divestment of Best World and Micro-Mechanics, the ratio of 5 out of 8 still looks good.

Looking at the table, it seems that I have a tendency to divest my non-core holding once it has done well. This is something which I wasn't aware of before this post. It will be something that I will take note of in future. Instead of divesting the counter after a strong performance, another option would be for me to spend more effort in understanding the counter and determine the possibility of turing it that into a core holding.

Punting on counters based on minimal information and uncertain business outlook continues to be a game of chance. Fu Yu went 10% up but Oceanus and Innotek went the other way. Not in a hurry to divest Oceanus and Innotek yet as amount put in was minimal, especially for Oceanus. Also, am still feeling positive of a possible turnaround next year or the year after next.

The table also highlighted the strong performance of my three counters in my CPF portfolio which returned 16% thus far. If this continues for the rest of the year, it will be the 9th consecutive year that my CPF portfolio beats STI ETF.

The following tables show the top gainers and losers for this year thus far. The list should remain pretty much the same by end of the year.

I am glad that 7 out of my 10 core holdings have returned more than 10% thus far this year. Even with the divestment of Best World and Micro-Mechanics, the ratio of 5 out of 8 still looks good.

Looking at the table, it seems that I have a tendency to divest my non-core holding once it has done well. This is something which I wasn't aware of before this post. It will be something that I will take note of in future. Instead of divesting the counter after a strong performance, another option would be for me to spend more effort in understanding the counter and determine the possibility of turing it that into a core holding.

Punting on counters based on minimal information and uncertain business outlook continues to be a game of chance. Fu Yu went 10% up but Oceanus and Innotek went the other way. Not in a hurry to divest Oceanus and Innotek yet as amount put in was minimal, especially for Oceanus. Also, am still feeling positive of a possible turnaround next year or the year after next.

The table also highlighted the strong performance of my three counters in my CPF portfolio which returned 16% thus far. If this continues for the rest of the year, it will be the 9th consecutive year that my CPF portfolio beats STI ETF.

Allocation

Dividend vs Growth

With the divestment of two core holdings and exploration of the US market, the allocation looked quite different from the the first half of the year. Cash stands at a high of 15%. Dividend yield of portfolio based on cost is at a low of 3.4%.

With the divestment of two core holdings and exploration of the US market, the allocation looked quite different from the the first half of the year. Cash stands at a high of 15%. Dividend yield of portfolio based on cost is at a low of 3.4%.

Planned

|

Actual

| |

Dividend

|

~ 60%

|

55%

|

REIT/ Business Trust

|

<= 30%

|

25%

|

Growth

|

~ 40%

|

30%

|

Punt

|

<=10%

|

3%

|

Cash

|

0%

|

15%

|

Singapore vs US

Being new to US market, I decided to allocated at most 15% of my fund to it till end of 2018. Currently, it stands at about 12% with 4% invested and 8% in cash.

Action

For the month of September, I have sold

- Dairy Farm at US$8.03 for a gain of 5.0%.

- Singapore O&G at $0.49 for a gain of 2.1%.

- mm2 Asia at $0.49 for a gain of 1.9%.

- Mapletree GCC Trust at $1.15 for a gain of 4.9%.

I have bought the first 3 in August due to their steep drop. Decided to divest them for a quick profit and re-invest them in other counters which I am more familiar with. As for Mapletree GCC, bought it last month with an incorrect understanding of the location of its HK property. Got lucky with it, so decided to take profit.

On the US Market, I have also sold

Dug into the numbers and checked the PE and growth rate of my US counters. The current PE for the first 3 stocks are all much higher than its historical average and PEG are all above 2. Hence, decided to divest them. As for Chiptole, there is currently too much uncertainty and so decided to stay away from it for the moment.On the US Market, I have also sold

- Cognex at US$114.45 for a gain of 3.4%.

- Mastercard at US$140.23 for a gain of 6.1%.

- Priceline at US$1840.60 resulting in a loss of 5.1%.

- Chipotle at US$307 resulting in a loss of 13.4%.

I have added

- more Straco at $0.87. Continue to like its cash generating business. This article by the "Rock" in NextInsight provides a good reading.

- more Hong Kong Land at US$7.28. Same reason as initial purchase in August. Cheap P/B and good results.

- more 800 Super at $1.085 as it continued to trend lower after its announcement of its Q4 results. Two quarters of weaker performances but it has continued to increase its dividend. Looking for a better performance in 2018.

- more Japan Food at $0.435. Same reason as initial purchase - consistent dividend.

- iFAST at $0.87. Its price has slid from its high after announcing a strong 1H results. While its China business will take some time to break even, its other countries performance is growing very well.

- Hock Lian Seng at $0.445. High visibility due to strong record book. If the company is able to maintain its dividend of 2.5 cents, then the yield is about 5.6%.

- ComfortDelgro at $1.995. Bought a tiny stake as I felt that it is oversold. While Taxi business is under great pressure, rail and bus are still doing well. Due to a sudden turn in its share price, I sold it today at $2.08 for a small gain of 2.8%.

Core holdings

Core holdings are counters which I am more familiar with. These are counters which I am more confident of and have a more substantial holding (at least 5% of portfolio); hence I am more likely to hold them for a longer period of time.

The current average holding period is about 2.4 years, as compared to 0.5 years for the remaining holding.

Divestment of Best World and Micro-Mechanics and purchase of VICOM has resulted in partial change of core holdings. These 8 (out of 26) holdings make up 53% of my outlay cost.

The current average holding period is about 2.4 years, as compared to 0.5 years for the remaining holding.

Divestment of Best World and Micro-Mechanics and purchase of VICOM has resulted in partial change of core holdings. These 8 (out of 26) holdings make up 53% of my outlay cost.

- Food Empire (9%) @ $0.46

- Raffles Medical (8%) @ $1.41

- Straco (8%) @ $0.85

- Parkwaylife REIT (6%) @ $2.32

- Valuetronics (6%) @ $0.54

- Fraser Centrepoint Trust (6%) @ $2.03

- VICOM (5%) @ $5.75

- Starhill Global (5%) @ $0.70

Looking Ahead

For the remaining quarter, I am looking forward to dividend from various REITs, 800 Super, RMG, SingTel, UMS, iFast and Japan Food. I am also hopeful of good quarterly result from Food Empire, Straco and Valuetronics which might have a positive impact on their prices. Raffles Medical Group should report another quarter of muted performance.

Barring any unforeseen circumstances, return for the year should be above 35%. With some luck, it might breach the 40% mark.

Subscribe to:

Posts (Atom)