Kingsmen caught my attention 9 years ago. My first purchase was in December 2006 and I accumulated more. over the next few years. However, I sold out (emotion at play) in December 2012 as share price tumbled due to fraud. I can't quite remember the details but reading through valuebuddies forum, the amount involved was small compared to the business and these were isolated cases.

I re-established a position in the company in mid-2013 and purchased more during the recent selldown. Here is my take of the company.

Business

Kingsmen provides clients with integrated solutions in Exhibitions & Museums, Retail & Office Interiors, Research & Design and Integrated Marketing Communications in the Asia Pacific region. Retail clientele include Christian Dior, Fendi, H&M, Shilla, Tiffany & Co., Uniqlo and others. Having seen their work in the shopping centres, I am impressed by their work. Some of the events that the company are involved in are F1 Sg, Singapore Sports Hub, Singapore Airshow and BNP WTA Finals.

As seen from the above, Kingsmen has established an impressive list of International clientele base that allows the company to generate recurring revenue and expand together with them.

Crunching the Numbers

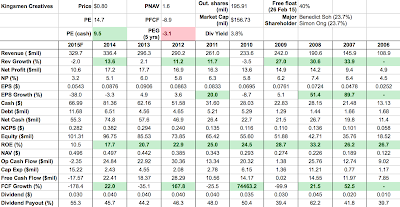

The image below shows the key financial figures of the company over the past 10 years. 2015 figure might not be accurate as it is based on the half-yearly results.

As seen from the data, revenue has tripled over the decade but the growth has slowed over the past 5 years. Net profit growth is more lumpy and again for the last 5 years, the numbers do not look as rosy. The low net profit margin of about 5% to 6% shows that the company does not have much pricing power and is probably in a competitive industry.

Return of Equity has been around 20 plus percentage but has dropped along the years. The company does not have much capital expenditure except on years when they are purchasing land and/or building new factory. This has resulted in a pretty healthy free cash flow over the past 5 years. The company has also been paying out about 40% to 50% of its income for dividend. For the latest half-year report, the company has cut its interim dividend from 1.5 cents to 1.0 cent.

Management

The two founders of the group Benedict Soh and Simon Ong still hold about 50% of the shares. The public face is Benedict who is the executive chairman and has featured in various interviews by the media over the year. While I have not attended any of the AGM or met any of them before, I am pretty confident of the team based on how the company has reported their results.

My Take

The company has enjoyed a period of good growth from 2006 to 2011 but over the last few years, it seems to struggle to maintain the momentum. I perceive the company is going through a period where it is preparing for the next phase of growth. The Executive Chairman's statement in last year annual report provides a glimpse of their current situation.

2014 was a fruitful year as we made strides in ramping up our production and human resource capabilities in anticipation of increasing demand for our products and services around the world. The acquisition of the Johor property was a strategic step towards establishing a permanent manufacturing base. We continued to upgrade and align the skills and knowledge of our people through the Kingsmen Academy, with training courses tailored to develop well-rounded individuals attuned to our business needs. We also sought to extend our expertise in the design and production of shop fixtures and decorations to the United States with the incorporation of our subsidiary, Kingsmen Projects US, in California in 2014. This is in line with our long-term view of the growth prospects for our business, as we continue to build and invest in facilities, processes and manpower.

- Benedict Soh, 2014 AR

Will they succeed? I definitely hope so since I have a stake in them.

My Action

I am holding on to my current holding and will continue to monitor the progress of the company through its quarterly report. I will not be adding more shares as it is already taking up near to 16% of my portfolio and there is no impetus for a higher stake. In fact, I might be reducing my holding if there is a need to raise cash to invest in another company that has a better story.

No comments:

Post a Comment